Banking Exam Reality Check: Speed Is Useless Without Accuracy

For most banking aspirants, speed has become an obsession. Candidates constantly try to increase attempts in mock tests, believing that more attempts automatically mean higher scores. However, the reality of banking exams tells a very different story.

In IBPS, SBI, and RRB exams, speed without accuracy does more harm than good. Many aspirants fail not because they are slow, but because they are fast and careless. This article explains why accuracy matters more than raw speed, how aspirants misunderstand exam strategy, and what a balanced approach actually looks like.

The Biggest Myth in Banking Exam Preparation

A common belief among banking aspirants is:

“If I attempt more questions, my chances of clearing will increase.”

This mindset leads to:

- Blind guessing

- Rushed calculations

- Poor decision-making

- Negative marking damage

Banking exams reward smart selection of questions, not reckless attempts.

Why Speed Alone Does Not Work in Banking Exams

Banking exams are designed with:

- Moderate-level questions

- Strict time limits

- Negative marking

This structure ensures that aspirants who lack accuracy are penalised heavily. A candidate attempting 75 questions with low accuracy often scores less than someone attempting 60 questions with high accuracy.

In real exams:

- One wrong answer cancels out the correct ones

- Guesswork destroys sectional balance

- Panic increases mistakes

Speed only helps when accuracy is already strong.

How Aspirants Confuse Speed With Efficiency

Speed means solving questions fast.

Efficiency means solving the right questions correctly.

Most aspirants:

- Try to solve every question

- Waste time on tough sets

- Ignore question selection

Efficient candidates:

- Skip time-consuming questions

- Focus on familiar patterns

- Protect accuracy

Efficiency, not speed, clears banking exams.

The Hidden Cost of Low Accuracy

Low accuracy affects more than just marks. It also:

- Lowers confidence

- Creates exam panic

- Causes poor time management

- Leads to inconsistent mock scores

Aspirants with poor accuracy often feel confused because they “study a lot” but do not see improvement.

Why Banking Prelims Especially Punish Guesswork

Banking Prelims (IBPS & SBI) are speed-based but accuracy-sensitive.

Key reasons:

- Cut-offs are close

- Competition is intense

- Each mark matters

Random attempts might increase attempt count, but they reduce final score. Toppers are not the fastest calculators; they are the best decision-makers.

Common Accuracy-Destroying Mistakes

1. Over-Attempting in Mocks

Candidates try to match topper’s attempt numbers without matching accuracy.

2. Ignoring Question Selection

Not all questions are meant to be solved.

3. Rushing Calculations

Small calculation errors cost valuable marks.

4. No Error Analysis

Mistakes are repeated because they are never reviewed.

Accuracy Is Built Before Speed, Not After

Many aspirants try to increase speed first and hope accuracy will follow. This approach is flawed.

Correct order:

- Build conceptual clarity

- Practise slowly with correctness

- Analyse mistakes

- Increase speed gradually

Speed built on weak accuracy collapses in the real exam.

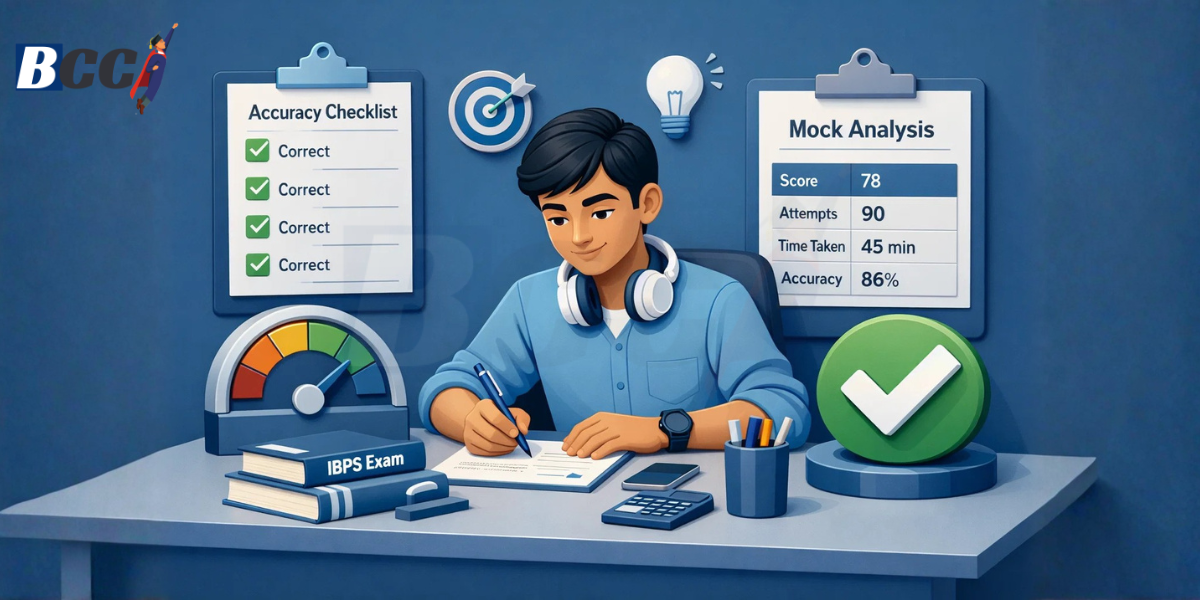

The Role of Mock Tests in Accuracy Improvement

Mock tests are not meant to:

- Show rank only

- Boost ego

- Compare with others

Their real purpose is:

- Identify weak areas

- Understand error patterns

- Improve question selection

Serious aspirants revise their mistakes after every mock. Structured environments, such as those followed at The Prayas India, emphasise mock analysis over mock frequency, which helps aspirants build accuracy consistently.

How Much Accuracy Is “Good Enough”?

A practical benchmark:

- 85–90% accuracy is ideal

- 80% accuracy is acceptable

- Below 75% accuracy needs urgent correction

If accuracy is low, increasing attempts is counterproductive.

Section-Wise Accuracy Focus

Quantitative Aptitude

- Calculation accuracy matters

- Fewer questions, higher correctness

Reasoning Ability

- Logical clarity over speed

- Avoid guess-based puzzles

English Language

- Accuracy is easiest to improve

- Grammar and comprehension should be strong

Balanced accuracy across sections is essential to clear cut-offs.

Accuracy Builds Exam Confidence

Candidates with good accuracy:

- Feel calm during exams

- Trust their decisions

- Avoid panic guesses

Confidence is not emotional; it is the result of consistent, correct practice.

A Practical Accuracy-First Strategy

- Practise questions untimed initially

- Focus on the correct method

- Maintain an error notebook

- Revise common mistakes weekly

- Take sectional tests

- Increase speed gradually

This strategy produces stable improvement, not temporary spikes.

Why Average Aspirants Fail Despite Hard Work

Most average aspirants:

- Study for long hours

- Solve many questions

- Ignore accuracy metrics

Without correction and revision, effort does not convert into results.

Guided preparation models that emphasise fundamentals, revision, and analysis help aspirants avoid this trap.

Conclusion

Speed is important in banking exams, but speed without accuracy is useless. Aspirants must stop chasing attempt numbers and start focusing on correctness, selection, and strategy.

Banking exams reward discipline, not desperation. Those who build accuracy first always perform better in the final exam.

Frequently Asked Questions (FAQs)

1. Is speed important in banking exams?

Yes, but only after accuracy is strong.

2. How can I improve accuracy in banking exams?

Focus on concepts, practise slowly first, and analyse mistakes regularly.

3. Should I attempt all questions in Prelims?

No. Attempt only questions you are confident about.

4. Can accuracy alone clear banking exams?

Accuracy combined with smart speed and selection leads to success.

5. How many mocks should I take?

Quality matters more than quantity. Analyse every mock properly.